Giving and taxes

The US government subsidizes donations through the tax code. This subsidy can have a huge impact for donors in high tax brackets.

This post covers two points in particular:

- The itemized deduction is huge—around 44-48% for tech workers in California [1]. This is essentially a donation match by the IRS; every itemized dollar donated is matched 80-90 cents by the IRS.

- $1 of highly appreciated stock is worth $1 to a charity, but only 70-80 cents to you, due to capital gains tax.

These stack in a surprising way; donating highly appreciated stock worth $1 to you results in the charity getting $2-4. This is useful to understand for a few reasons:

- Knowing that every donated dollar is matched 1-3x can be a motivating factor in itself to give.

- If you have appreciated stock, it is often materially better to donate the appreciated stock (vs donating cash).

- In some common circumstances, "bunching" donations can result in the charity getting thousands of extra dollars a year.

The IRS gift match

I'll start by running through the calculation, and then touch on implications and FAQs.

Tax assumptions. To simplify things, for the rest of this post, I'm going to assume

- You have enough itemized deductions to get over the standard deduction hurdle. Often this is achieved if you have a mortgage, or are donating at least $3k (if single/RDP, $16k if married). You may need to add $10k to these numbers if you don't pay state taxes in any form.

- You are donating less than 30% of your pre-tax income.

I'm also going to make the following tax bracket assumptions. I'll link to a calculator at the end where you can run the calculations with your own numbers.

Itemized deductions

Itemized deductions directly lower your taxable income. Charitable deductions count as itemized deductions.

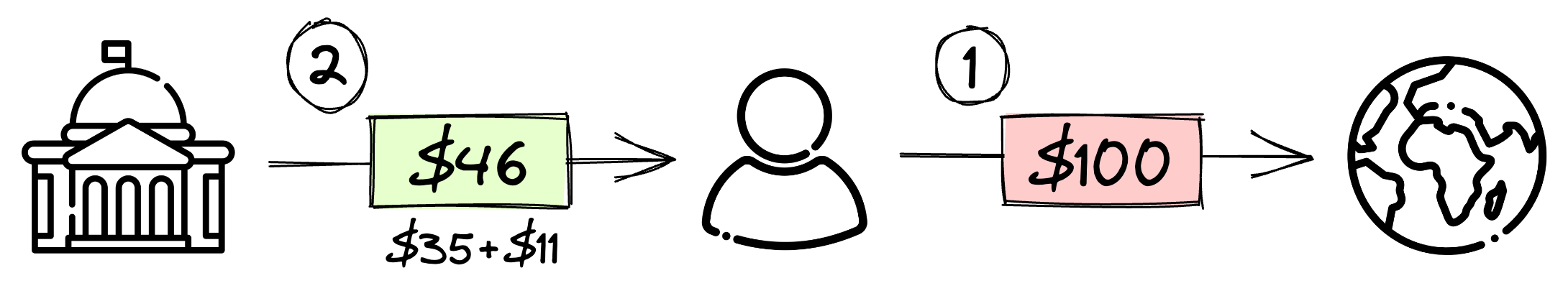

Say you donate $100 in cash. The charity gets $100 (woohoo!).

Next year, when you file your taxes, your taxable income will be $100 lower than it otherwise would have been. Your federal tax refund will be $35 higher and your state tax refund will be $11 higher than it otherwise would have been:

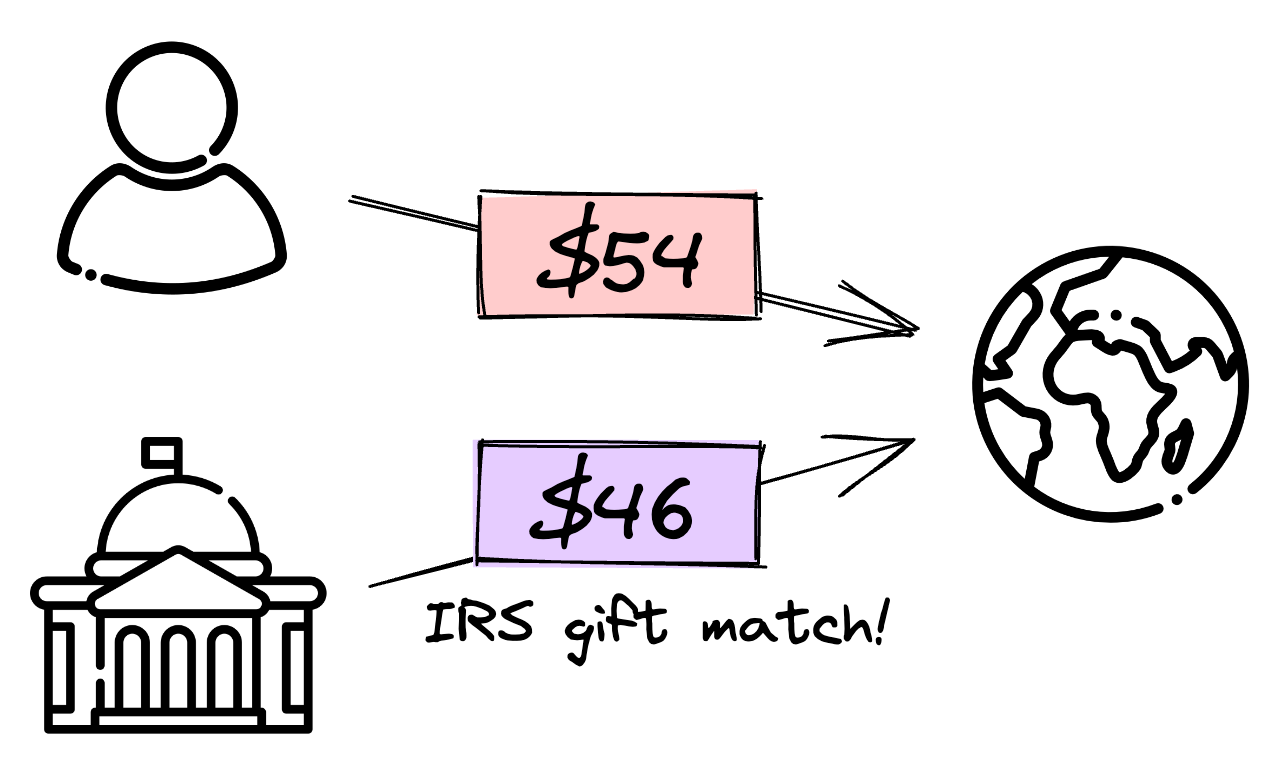

To summarize, you donated $100, and got $46 back. So, in net, you spent $54 [= $100 - $46] for the charity to get $100.

So the IRS is essentially matching your donation 85 cents to the dollar [85 = 100 * 46/54]!

There is one subtlety here that can sometimes have a material effect—the itemized deduction match only really applies to donations past the standard deduction hurdle. See footnote [2] for more details.

Long term capital gains

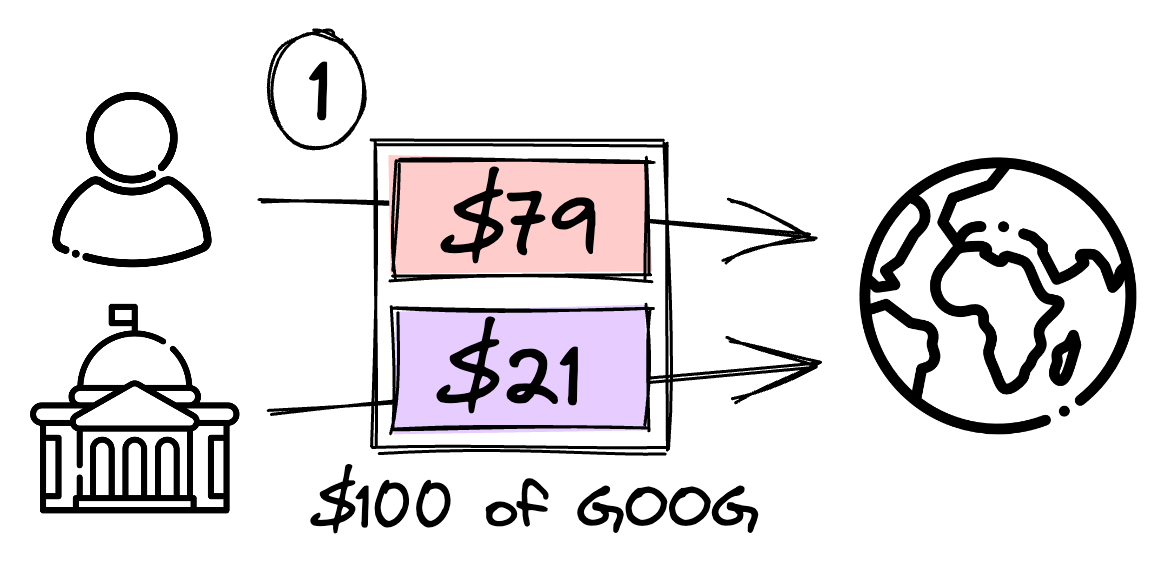

Let's say instead of donating cash, you donate some Google stock (or index fund shares) you got at $30, that are now worth $100, and that you've held for at least a year.

The charity gets $100 (woohoo!). They will likely sell the shares immediately and turn it into cash. They do not pay taxes on this conversion.

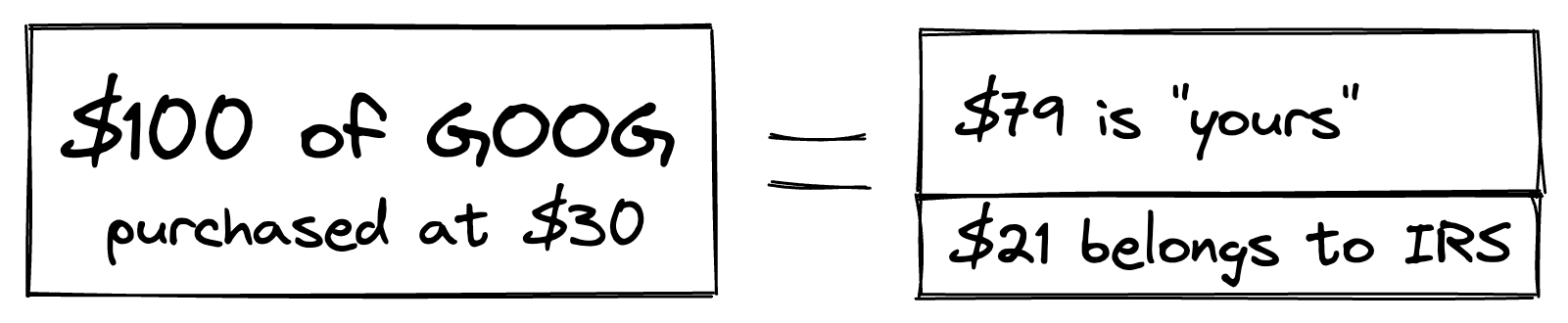

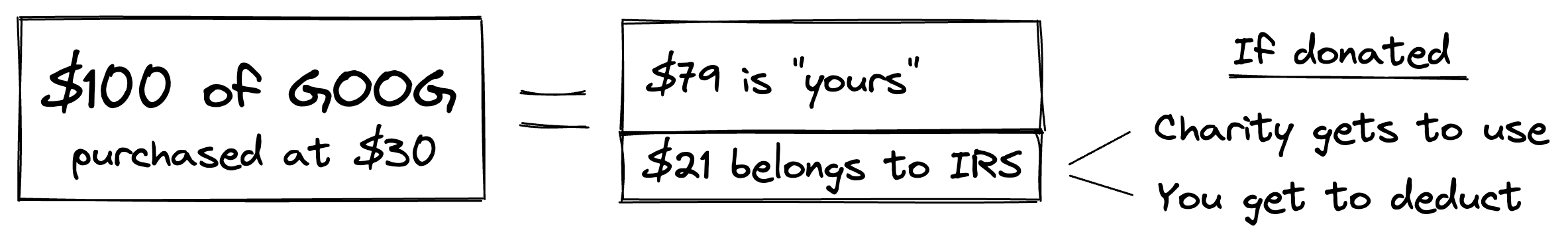

However, and this is subtle, it's worth noting that you never really had $100 in the first place. Appreciated shares are inherently worth more to a charity than they are to you.

As a hypothetical, let's say instead of donating the stock, you had used it to buy something. You would have had to sell the shares in order to do so, but unlike for charities, this conversion to cash is not free for individuals. You have to pay capital gains tax and net investment income tax on the [= $100 - $30] of gains. This tax is (15 + 4)% federally and 11% for state, for a total of $21 [= $70 * (15 + 4 + 11)%].

So, it says $100 in your brokerage account, but if you actually tried to use it for anything (other than donations), you would immediately owe the IRS $21.

Let's go back to our original scenario, where we donate the $100 of appreciated GOOG. The first step from above now looks like this:

As you can see, we get a small donation match right away! Appreciated shares are inherently worth more to a charity than they are to you.

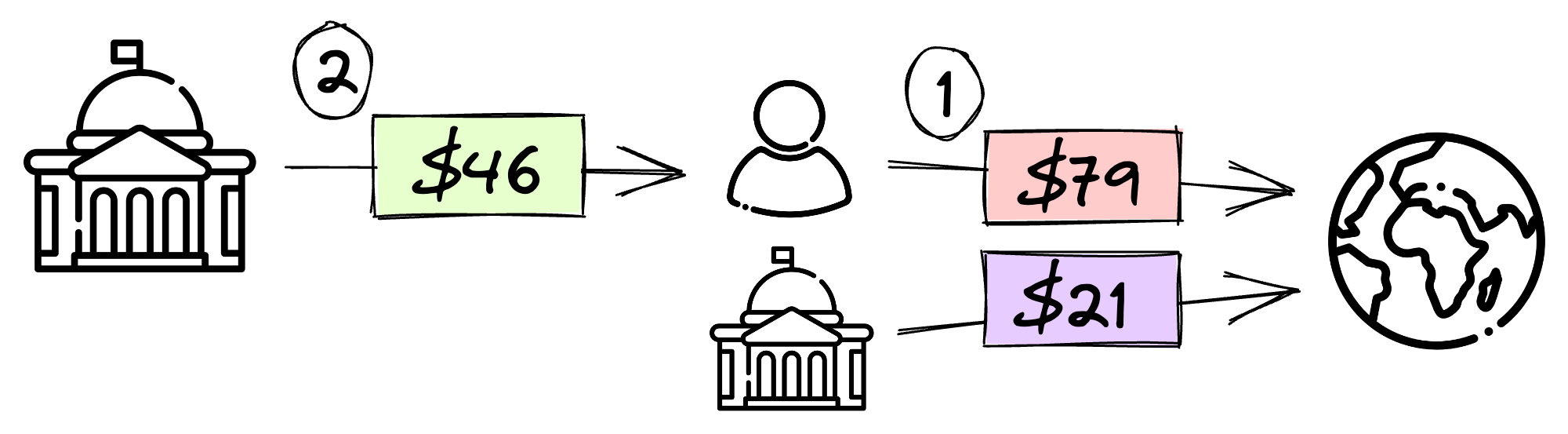

Now for the second step. Just like with cash, stock donations count as itemized deductions. You might expect that you would deduct $79, since that's all you "had". It turns out that you actually deduct the full $100, as a further incentive from the IRS!

All in all, you get to dip into the $21 two times over, even though it wasn't really even "yours" in the first place.

Deducting the full $100 results in $46 back at tax time, as before:

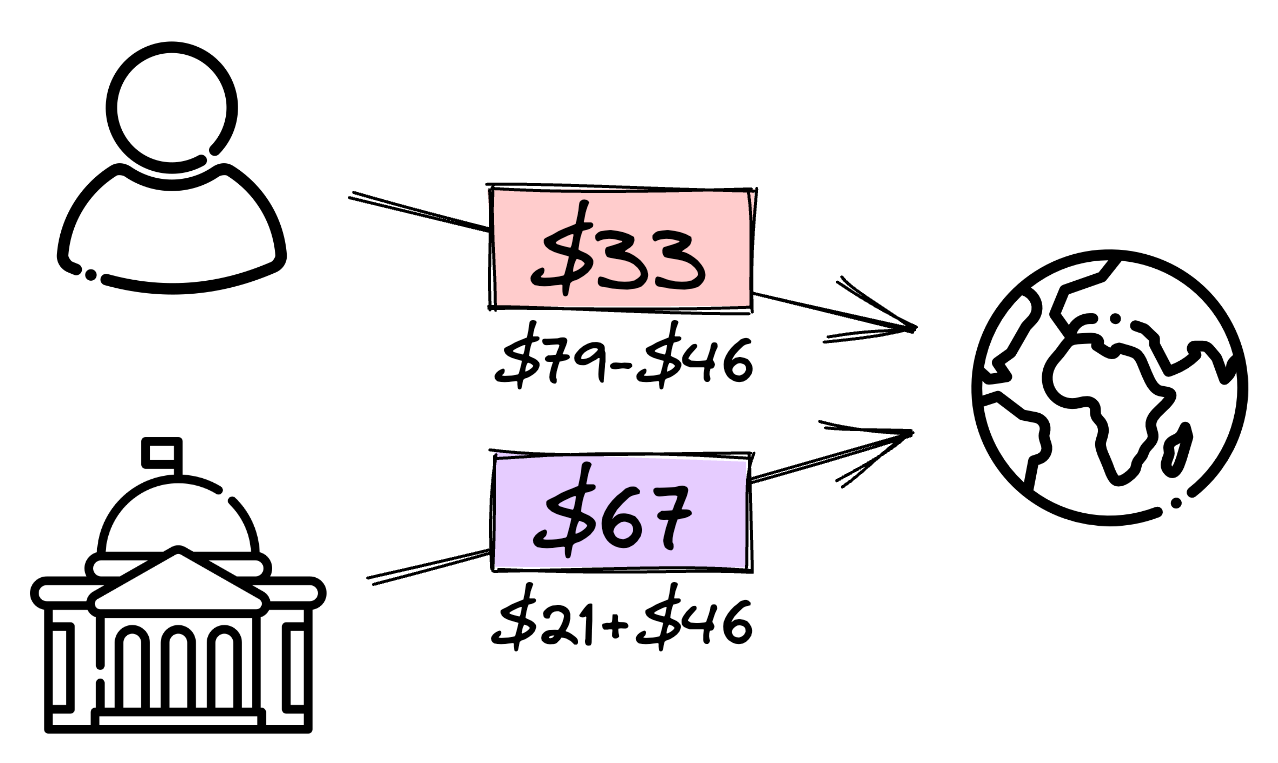

Subtracting the $46 credit from the $79 spent, we have:

So, in net, you spent $33 for the charity to get $100.

In other words, for every dollar of spendable money you donated (as stock), the IRS put in another $2.

You could have bought the Google shares at $10 or $90 instead of $30. See this spreadsheet to run the calculation with your own numbers.

Implications

- When donating to charity, consider donating your most appreciated stock / index fund / crypto holding / etc rather than donating cash. All corporate gift match programs that I'm familiar with match non-cash donations (though of course, double check your situation).

- If you have a highly appreciated asset, and are in a high-tax situation, consider donating it instead of selling it!

- If you don't normally reach the itemized deduction threshold, consider bunching your donations. For example, instead of donating $10k each year, consider donating $25k every other year (or whatever amount ends up being the same out of pocket cost). If you still want a roughly yearly cadence, you can donate $12.5k in January and $12.5k in December, every even-numbered year, or use a Donor Advised Fund (DAF), like daffy.org, and put in $25k every other year. Some charities even "count" January donations towards the previous year.

FAQ

It applies to all 501(c)(3) charities. Most established US charities are 501(c)(3) organizations, and large international charities also tend to have a qualified US entity. Religious organizations are generally 501(c)(3)'s, and political organizations are generally not. If you're not sure about a particular charity, try Googling "<name of charity> 501c3".

First transfer the shares to a donor advised fund, e.g. https://daffy.org/membership. You can convert your shares to cash tax-free inside the fund. The $3/mo plan will be sufficient for many donors. Ignore all the investment stuff, and just use it to convert your non-cash asset to cash a few weeks before you donate it.

If you're up for a bit of complexity, Giving and taxes: advanced strategies has some ideas.

In most cases, it's simpler to wait for your company to go public. I do know of one large company though that allowed its employees to donate shares during a tender offer, so it may be worth asking, especially if the leadership team is charitably minded. Feel free to reach out if you're in this situation; happy to discuss the specifics!

Charitable deductions still apply under AMT. Just use your AMT tax bracket (should be either 26% or 28% federally, and then varies by state) in the calculator linked below.

I think there are a few ways to think about what one's fair share of taxes is:

- The letter of the law, e.g. how much you would pay if you hired someone to manage your money.

- The spirit of the law. For example, your work may offer a mega backdoor roth IRA conversion, but you might feel icky about taking it since it's not really clear that the government intended for that backdoor to exist. By contrast, you may be ok with regular 401(k) deductions, or the mortgage interest deduction, since you're using them as designed.

- The spirit of the law, as it should exist. For example, California Prop 13 artificially limits property taxes, in a way that many people feel is bad policy. As a homeowner, maybe you choose to overpay property taxes according to a formula that you believe is more fair.

I think it's fairly clear that charitable deductions are both the letter and the spirit of the law. The IRS even publishes pieces like https://www.irs.gov/about-irs/the-irs-encourages-taxpayers-to-consider-charitable-contributions, which makes it feel like they explicitly think of the tax deduction as a lever to encourage people to donate. If planning your giving around charitable deductions intuitively feels against the spirit of the law (but making plans based on the 401(k) deduction or the mortgage interest deduction does not), I would be interested to understand where that feeling comes from.

For the higher bar of "the spirit of the law as it should exist": this is a more speculative musing, but my understanding of the 501(c)(3) subsidy is that it is essentially an extension of the US welfare system. Many basic functions (like feeding the homeless) that are done directly by government programs in Europe are instead partly done by private organizations in the US. Each dollar you donate is effectively a vote of confidence in that charity, and the US government uses that information to distribute its welfare dollars.

Gotchas

The most important bullet point here is the first one.

- Most brokerages require a few weeks to process stock donations, which means you'll need to have your stock donations done by early-to-mid December to count it against that year. If this is the first time you're donating stock, consider starting at the end of November.

- Donating >$5k of crypto requires an appraisal, which you can get at https://cryptoappraisers.com. You get the appraisal after you do the donation.

- The itemized deduction for donating appreciated stock is capped at 30% of your pre-tax income. There are itemized deduction limits for donations overall (e.g. if you donate cash in addition to stock), though they vary by state and recipient organization. The limit for donations overall (cash + stock) is usually 50% or 60% of pre-tax income, but can be as low as 30%.

- If you make enough money, California will reduce some of your state itemized deductions. See "Reduction in itemized deductions" in this pdf for the exact formula, and this spreadsheet for instructions on how to modify the calculation if you expect to be subject to this. This doesn't change the calculus of donating stock vs donating cash, but it can be another reason to consider bunching donations.

- It doesn't make sense to donate stock that has lost money. Instead, sell it and then donate the money. Also, all this only applies to stock you have held for at least one year.

Most importantly, if any of the above sounds confusing or scary, there is help available! That help is me. I'm happy to help plan out or execute a donation strategy, including finding the right forms, verifying tax laws for an unusual situation, or being on zoom/chat while you create a daffy account.

Calculate your donation multiple

You can use this spreadsheet to run the calculation with your own tax bracket numbers.

We'll need a few definitions first:

- Appreciation multiple (AM): How much the non-cash asset has appreciated. If you bought GOOG at $30 and it's now worth $100, the appreciation multiple is 3.33 [= $100 / $30].

- Donation multiple (DM): How many dollars the charity gets for every dollar of spendable money that you donate. In the worked out example above, the donation multiple is 3, since for every $1 that you put in the IRS puts in another $2.

If you don't know your tax bracket off the top of your head (i.e. most people), you'll need to use your household income to look it up. You can roughly approximate it by adding the value of all salary, equity (if you work at a public company), and bonuses if relevant. TODO: If you're not sure, check your last year's tax return. Your taxable income is on federal form 1040 (the main one), line 15. Another option is to check last year's W-2, Box 1.

Footnotes

[1] This post uses tax brackets representative for tech employees in California. That said, nothing other than the tax brackets are specific to tech or California. After reading the post, you can use this spreadsheet to run the calculation with your own numbers.

[2] When you take one or more itemized deductions, you forgo something called the standard deduction. Donating can cause you to switch from the standard deduction to itemizing deductions, in which case there is essentially some standard deduction being left on the table.

Let your "standard deduction hurdle" be your standard deduction minus all non-donation itemized deductions. For example, let's say your standard deduction is $13k, and your non-donation itemized deductions are $11k. Your standard deduction hurdle would be $2k [= $13k - $11k]. The IRS itemized deduction match discussed in the main text would only apply past the first $2k of donations.

This is because if you don't donate at all, you would take the $13k standard deduction. If you donate X, you would take itemized deductions totalling $11k + X. The additional deduction you get from donating is ($11k + X) - $13k, or X - $2k. This is why it's reasonable to think of the itemized donation match as only applying past the standard deduction hurdle.

How impactful is this? Some typical numbers for the standard deduction are: $13k if single, $19k for head of household, and $26k if married. Some typical itemized deductions are $10k for the state and local tax deduction, and $20k+ for the mortage interest deduction. So, if you have a mortgage, often the standard deduction hurdle is $0, and if you don't, it ranges from $3k to $16k. This is all at the federal level; a similar (but less impactful) calculation applies at the state level as well.

If you typically donate close to your standard deduction hurdle, you can bunch donations by donating twice as much every other year, or use a donor advised fund (see Giving and taxes: advanced strategies). This reduces the impact of the hurdle.

Date: April 2023

Author: Rishi Gupta